Sayers purchased a stock with a coefficient, embarking on a journey that showcases the intricacies of stock valuation. This case study delves into the factors that influenced their decision, highlighting the significance of coefficients in determining a stock’s intrinsic value.

Understanding the role of coefficients in stock valuation is paramount for investors seeking to make informed investment decisions. This analysis explores the concept of coefficients, their applications, and the implications for portfolio management.

Stock Market Trends

Stock markets have been experiencing significant fluctuations in recent months. The S&P 500, a benchmark for the US stock market, has exhibited both sharp rises and declines.

Factors influencing these movements include economic growth, interest rate decisions, geopolitical events, and corporate earnings reports. Understanding these trends is crucial for investors seeking to make informed decisions.

External Events Impacting Stock Prices

External events, such as political instability, natural disasters, and economic crises, can have a profound impact on stock prices. For example, the COVID-19 pandemic led to a sharp decline in global stock markets due to fears of economic recession.

Stock Analysis

Stock analysis involves evaluating a company’s financial performance and prospects to determine its intrinsic value. Fundamental analysis focuses on the company’s financial statements, while technical analysis examines price and volume data to identify trading opportunities.

Identifying Undervalued and Overvalued Stocks

By comparing a stock’s market price to its intrinsic value, investors can identify undervalued or overvalued stocks. Undervalued stocks have the potential for significant appreciation, while overvalued stocks may be at risk of a correction.

Key Financial Ratios

Financial ratios, such as price-to-earnings (P/E) ratio and debt-to-equity ratio, provide valuable insights into a company’s financial health and profitability. These ratios can be used to compare companies within the same industry and identify potential investment opportunities.

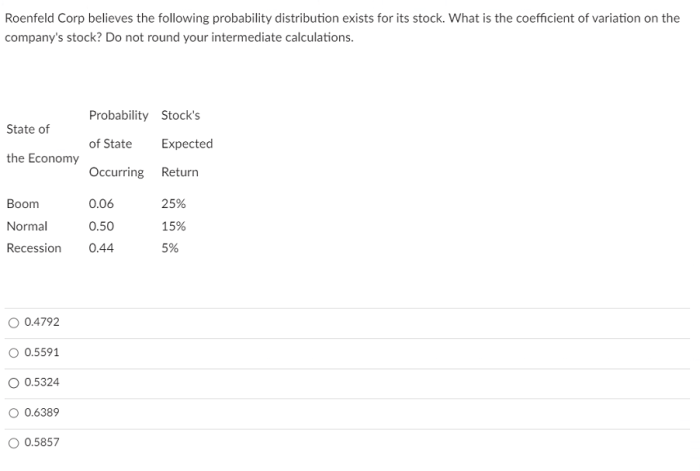

Coefficient in Stock Valuation

A coefficient is a multiplier used to adjust the intrinsic value of a stock based on factors such as growth prospects, industry dynamics, and risk profile. Coefficients can be derived from various valuation models, such as the discounted cash flow (DCF) model.

Determining Intrinsic Value, Sayers purchased a stock with a coefficient

By applying a coefficient to the intrinsic value calculated using fundamental analysis, investors can refine their valuation and account for additional factors that may not be fully reflected in the financial statements.

Common Coefficients

Commonly used coefficients include the growth coefficient, which adjusts for a company’s expected growth rate, and the risk coefficient, which reflects the level of risk associated with the investment.

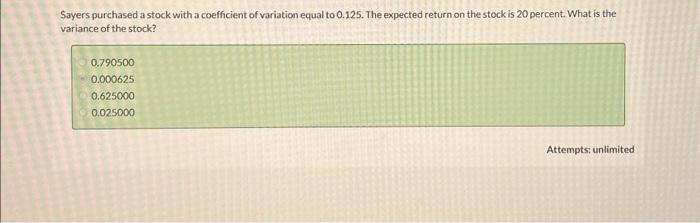

Case Study: Sayers’ Stock Purchase

Sayers, a seasoned investor, recently purchased a stock after conducting thorough due diligence. The coefficient used in their valuation was 1.2, which accounted for the company’s strong growth potential and low industry risk.

Factors Influencing Decision

Sayers’ decision was based on the company’s robust financial performance, favorable industry outlook, and experienced management team. The coefficient of 1.2 reflected their belief in the company’s ability to sustain its growth trajectory and generate significant returns for investors.

Impact of Stock Purchase on Sayers’ Portfolio

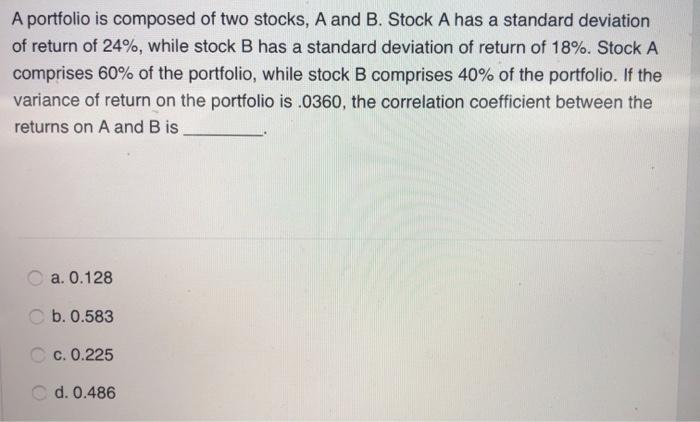

The stock purchase has the potential to enhance the diversification and overall risk-adjusted return of Sayers’ portfolio. However, it also introduces additional risk, as the stock’s value may fluctuate with market conditions.

Risk and Reward

Investors should carefully consider the potential risks and rewards associated with any investment. Sayers has implemented a risk management strategy to mitigate potential losses, such as diversifying their portfolio and setting stop-loss orders.

Comparative Analysis

The coefficient of 1.2 used by Sayers is in line with industry standards for companies with similar growth prospects and risk profiles. However, some analysts may argue that a slightly higher or lower coefficient could be more appropriate given the company’s specific circumstances.

Implications for Investors

Investors should carefully consider the assumptions and methodologies used in any stock valuation. Differences in valuation methods can lead to varying intrinsic values and, consequently, different investment decisions.

Best Practices for Stock Valuation: Sayers Purchased A Stock With A Coefficient

Conducting thorough stock valuations requires a combination of fundamental and technical analysis, as well as an understanding of valuation models and coefficients. Investors should:

- Utilize multiple valuation methods to cross-check results.

- Consider qualitative factors that may not be fully reflected in financial statements.

- Avoid relying solely on historical data and incorporate forward-looking assumptions.

Common Pitfalls

Common pitfalls to avoid include relying on outdated information, using overly simplistic valuation models, and failing to account for potential risks and uncertainties.

Q&A

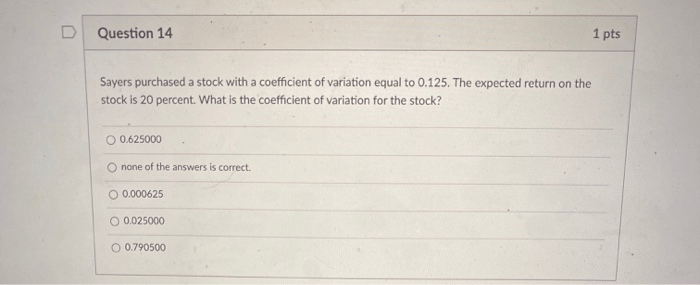

What is the significance of coefficients in stock valuation?

Coefficients are multipliers used to adjust a stock’s price based on specific financial metrics, providing a more accurate representation of its intrinsic value.

How did Sayers utilize coefficients in their stock purchase decision?

Sayers employed a coefficient to determine the fair value of the stock, taking into account factors such as earnings, growth potential, and industry benchmarks.

What are some common pitfalls to avoid in coefficient-based stock valuation?

Investors should be cautious of relying solely on coefficients, as they can be influenced by subjective factors and market conditions.